The future of ecommerce: the six key trends you need to know for business growth in 2021

At Linnworks we’ve seen many ecommerce businesses experience unprecedented growth in 2020, but also many business challenges with demand for certain categories offset by supply chain and shipping challenges. The resulting changes in consumer behaviour and purchasing decisions are likely to become permanent with many customer journeys continuing to take place online, even when physical retail scales back up to operate at pre-pandemic levels.

To build on this momentum around ecommerce in 2020, businesses need to adapt strategies around key areas of their business to remain competitive in 2021. At Linnworks, we’ve identified 6 key ecommerce trends emerging from 2020’s disruption and key to continuing successful business growth in 2021:

- The growth of total commerce

- Customer experience is key to growth

- Personalizing the entire shopping experience with data

- The rise of direct-to-consumer (D2C) selling

- Shopping as part of everyday media consumption

- Diversification of supply chains

Trend 1: The growth of total commerce

Research by Google shows that 84% of Americans are shopping for something at any given time in up to six different categories.

The always-on mindset means customers are always open to being marketed to. No longer do they head to a shopping center with the main goal of buying a specific item. A Facebook ad in their news feed is the modern-day equivalent of a trip to the mall—even if they never intended to hand over their money in return for goods when they initially fired-up the app.

This accelerated adoption of online shopping throughout the pandemic means customer expectations are rising faster than ever before.

Shoppers expect a consistent brand experience across all channels – 87% believe brands need to put more effort into providing a seamless shopping experience.

Why? Because customers don’t always head to a computer and think: “I want to buy this item.” It’s reported that seven in 10 customers shop in micro-moments throughout the day when they’re performing other non-brain intensive tasks, such as watching TV or waiting in line.

The effortless economy is in full swing. People are consuming more media than ever before. They’re watching TV and using social media without much thought or disruption to their daily life.

If something from one of those channels convince them to buy, it needs to be effortless, too. Consumers want to follow the path of least resistance—even when buying online. They want to be able to purchase products instantly, whenever (and wherever) they see them.

Take in-app checkouts, for example. Instagram’s shopping feature lets consumers purchase products without leaving the app. Facebook’s new Shops feature makes it even easier for customers to buy products they see in their News Feed. Even traditional entertainment channels like TV have manufacturers introducing ecommerce-enabled applications. It’s this reason why commerce is no longer defined by a location or a domain. It’s increasingly owned by brands that place themselves in the environments where their customers are.

Total commerce exploits this always-on mindset. It’s a strategy that meets the consumer everywhere they want to shop, on any device they could use. Total commerce is what consumers want unlimited access to.

Marketplaces, social media platforms and mobile commerce all play a role in omnichannel retail. The total commerce approach means brands reach customers when they’re shopping in those micro-moments, wherever they are (and whichever device and platform they’re using).

To capitalize on this—and avoid losing market share to other retailers—online sellers need to sell to the customer wherever they choose to shop (even if they don’t recognize they’re doing so). Granted, your website plays a huge role in a customers’ journey. But creating a connected, seamless shopping experience across each platform, device and channel is a necessity for standing out when customers have more choice than ever.

Brands that have a strong ecosystem of shopping channels and experiences for customers will be the winners in capturing online shoppers attention and purchases.

Trend 2: Customer experience is key to growth

Did you know that companies with a major focus on customer experience drive revenue 4-8% higher than others in their industry?

Failing to deliver on your customer’s expectations is a guaranteed way to give them a poor experience. That could add your brand to their blacklist—something you’d want to avoid at all costs. A survey by RetailEXPO of UK consumers found that 55% of shoppers cite time-consuming processes such as checkout and completing data capture forms as a barrier to shopping online. Other factors such as payment options and returns processes and policies also had an impact on the likelihood of conversion and return business from customers.

After all, true value is in repeat sales- 65% of a company’s business comes from previous customers. Plus, it costs five times as much to acquire new customers than to retain existing ones.

As we head into 2021, customer experience isn’t as simplistic as delivering a good product to each customer. A superb customer experience is end-to-end, from a frictionless product search to a seamless purchase journey and convenient delivery and returns policy. To be competitive, every point of interaction a consumer has with a retailer has to be as frictionless as possible.

Forcing shoppers to jump through hoops to find and buy your product won’t land you their loyalty, or even the sale. It’s why tools which communicate with your customers throughout their sales journey — such as chatbots automatically answering questions and customer reviews and ratings — shine. They guide someone through common purchase objections and nudge them towards a sale.

Other deciding factors also play a role in whether your customer buys from you—including trust signals. Delivery policies front-and-center, for example, help customers assess whether the item would arrive in the timeframe required. It’s why 76% of online shoppers cite fast shipping speed as a top characteristic of a great shopping experience.

When it comes to actually handing over their money in return for a product, payment options in the “buy now, pay later” niche—such as Klarna, Affirm, Sezzle and AfterPay—are taking the reins.

Over a million daily transactions are processed through Klarna alone. Launched in 2014, Klarna is now a payment partner to over 190,000 businesses in 17 countries, reflecting how popular this payment option has become with shoppers. Customers actively look for these “buy now, pay later” deals when they’re online shopping.

One in three respondents have already used the services to make a purchase. And with COVID-related lockdowns wreaking havoc with consumer finance, pay later methods have seen a 200% increase during the pandemic.

Failing to include these types of flexible payment options is another reason for potential customers to jump ship to a competitor who does.

Returns policies have a similar effect. Details on how to return an item give potential customers trust in the fact they can return it if they no longer need it, or it doesn’t do what they expected, with no additional cost or convenience. Being transparent about your returns policy during the purchase process can increase a shopper’s propensity to complete the transaction.

Data shows that a negative experience while returning items—such as paying for returns delivery or being unable to return items—can deter customers from shopping with a brand again. That doesn’t do any favors for building customer loyalty.

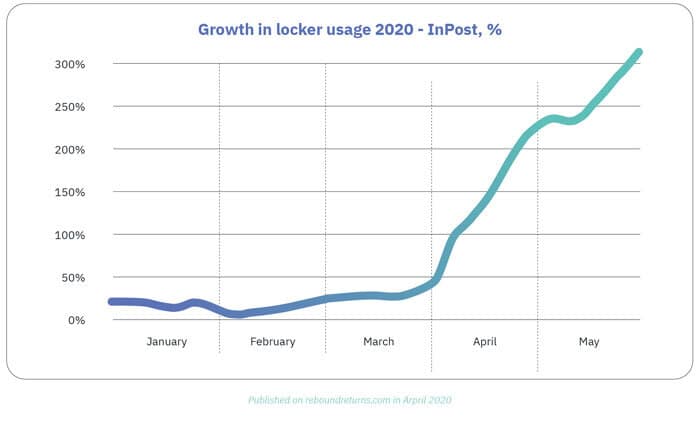

So what does a good return experience look like? The answer lies within the fact that contactless returns have skyrocketed throughout the COVID-19 pandemic.

The growth of self-service lockers has risen by almost 300% since the start of the year. Returns policies that allow customers to drop-off unwanted items in self-service lockers, such as InPost, UPS, USPS and Hermes, provide customers with flexibility and convenience. Removing friction in the returns process is as important to the customer experience as the purchase process.

Customer experience should be a key part of your conversion and loyalty strategy. The more you continue to analyze and improve each point of interaction with your customers, the greater competitive advantage your customer experience will provide.

Trend 3: Personalizing the entire shopping experience with data

Speaking of customer loyalty, personalized experiences are what makes customers purchase and stick around for the long-run.

Long gone are the days of creating a one-size-fits-all marketing message to push to customers. Expectations are higher – 72% of shoppers would only engage with marketing messages that are customized to their interests.

The good news is that we have more data available than ever. Analytics tools and ecommerce software can help retailers find out who their customers really are—and how they shop online. Some information you can capture to build a picture of your customers include:

• How people arrive at your site and which of your offsite channels are driving revenue

• Who your customers are in terms of their demographics, and even their likes and interests in some instances

• How they interact with your site and which content elements are driving purchases

• Shopping frequencies, brand and other purchase preferences that can be used to tailor their journey

Customers actively want brands to use this data to provide personalized shopping experiences.

The vast majority (91%) of people are more likely to shop with brands who provide relevant offers and recommendations. You can only provide those recommendations by collecting the above data on your target customer.

Again, personalized shopping experiences are end-to-end. With website optimization tools,

you can test microtasks in the customer journey to drive conversion. If your customer is interacting with your website in a logged-in state, you can record and optimize every interaction. Using a customer’s data to nudge them towards a sale can span activity across the entire purchase journey.

Abandoned cart emails are just one example. Various tools (such as Facebook, Privy and CartStack) can collect data on the products an individual customer adds to their online shopping cart without purchasing. An automated email activity is triggered as the customer leaves the site to remind them of their interest and nudges them back to the site to complete their purchase. Rather than waiting for customers to seek out your product, identifying and proactively delivering personalized product recommendations to your existing customers are the key to driving growth with your customer base and avoiding having your competitors interrupt these transactions.

These product recommendations typically account for up to 31% of ecommerce revenues. Using data you’ve already collected on customers, and serving products based on these preferences builds the relationship with your customer base. Using your customer profiles as a basis for targeted marketing campaigns to look-a-like audiences improves the efficiency of your marketing spend by converting more customers with a similar profile to your most profitable, existing customers.

It’s why Gartner predicts a 15% profit boost for merchants who successfully use personalization to create more tailored customer experiences online. The volume of data in any business can be overwhelming to interpret, but you can start small with simple targeting opportunities or personalization by segment and build from your successes.

Trend 4: The rise of direct-to-consumer (D2C) selling

Store closures in high streets and shopping malls were one of the first outcomes of international lockdowns.

As foot traffic on the high street and in malls dropped by more than 40% compared to the previous year, brands reliant on retail partners to reach their customers suddenly lost access to a critical sales channel. To survive, many wholesale businesses had to quickly pivot their business and find new online outlets to reach their customers directly.

Because of the uncertainty surrounding the return of the conventional high street and malls, building a brand and establishing direct channels to the consumer will need to become a significant consideration of any business’s future growth strategies. This trend was already on a strong growth trajectory with direct- to-consumer ecommerce growing at three to six times the rate of overall ecommerce sales between 2016 and 2019. More than half of these direct-to-consumer brands have also experienced surges in demand since the start of the pandemic.

With the growth of shopping channels to reach consumers directly and fulfilment businesses to handle the heavy lifting, many of the barriers for shifting to D2C have been lowered for brands. The benefits of owning the direct relationship with their customers, greater ownership over their brand experience and increased margins from selling direct have made this an appealing strategy for brands looking to consolidate their business.

Direct-to-consumer business models are being welcomed by customers. Data by Diffusion shows a third of U.S. consumers plan to do at least 40% of their shopping from direct-to- consumer companies in the next five years. Their reliance on marketplaces is diminishing as the experience of interacting directly with their favourite brands improves.

Successful direct-to-consumer brands have been getting up to 50% of their sales from returning customers. One key strategy that has proven successful for many D2C brands is rewarding customers for their loyalty. Whether customers collect points, or simply get discounts to redeem on future purchases, rewarding your customers with benefits for frequenting your business can be a strong driver of return business.

Subscription models, discounts for regular purchases and exclusive and early product access are some of the ways direct-to-consumer brands have created new types of purchasing models to maintain loyalty with customers.

Brands can also get the best of both worlds with direct-to-consumer business models that incorporate multiple selling channels. They build loyalty with customers with their own retail presence, but can also reach the huge, instantly accessible audiences that marketplaces and social channels have built.

Take Amazon for example. Over 214 million people visit their website every month. Direct-to-consumer retailers can build an Amazon storefront to access this active shopping audience, alongside owned channels like their website. Similarly, with Facebook Shops and Pinterest Storefront profiles, the ability to build a brand presence across the channels where your customers are spending their time increases the visibility and ease of interacting with your brand, and therefore the tendency of your audience to shop directly with you.

Whichever strategy you use to build loyalty and encourage repeat orders, going directly to the consumer offers two major benefits that traditional retail networks don’t.

The first is better profit margins. You’re bypassing traditional retail networks when selling directly to the customer, which means a higher margin per sale. There’s no need to factor in a cut the marketplace will take on each order.

The other is extra data. Remember how we mentioned data is the foundation of personalization—something customers say they want their shopping experience to feature?

A direct relationship with the end customer means brands and manufacturers can get a complete picture of their customer base by collecting the shopping data only their traditional networks would otherwise have had access to. The D2C experience can be personalized from the first interaction, right through to purchase, which otherwise wouldn’t be an option when trading through complex retail chains.

Trend 5: Shopping as part of everyday media consumption

Brands can also get the best of both worlds with direct-to-consumer business models that incorporate multiple selling channels. They build loyalty with customers with their own retail presence, but can also reach the huge, instantly accessible audiences that marketplaces and social channels have built.

Take Amazon for example. Over 214 million people visit their website every month. Direct-to-consumer retailers can build an Amazon storefront to access this active shopping audience, alongside owned channels like their website. Similarly, with Facebook Shops and Pinterest Storefront profiles, the ability to build a brand presence across the channels where your customers are spending their time increases the visibility and ease of interacting with your brand, and therefore the tendency of your audience to shop directly with you.

Whichever strategy you use to build loyalty and encourage repeat orders, going directly to the consumer offers two major benefits that traditional retail networks don’t.

The first is better profit margins. You’re bypassing traditional retail networks when selling directly to the customer, which means a higher margin per sale. There’s no need to factor in a cut the marketplace will take on each order. The other is extra data. Remember how we mentioned data is the foundation of personalization—something customers say they want their shopping experience to feature?

A direct relationship with the end customer means brands and manufacturers can get a complete picture of their customer base by collecting the shopping data only their traditional networks would otherwise have had access to. The D2C experience can be personalized from the first interaction, right through to purchase, which otherwise wouldn’t be an option when trading through complex retail chains.

Traditionally, customers would buy products in one of few ways:

1. Finding their site through a Google search

2. Viewing advertisements either online or in-person

3. Going directly to a retailer’s website

However, new channels have emerged which integrate shopping into the digital channels where people are spending their leisure time.

Data from We Are Social showed that social media adoption grew 12% in the last 12 months with the time spent in these channels accelerating. Screen time also increased with users connected to devices for an average of almost 7 hours per day, up by 25% on the same time last year. This presents a significant opportunity for brands and retailers to interact with consumers by integrating storefronts and products into these digital channels.

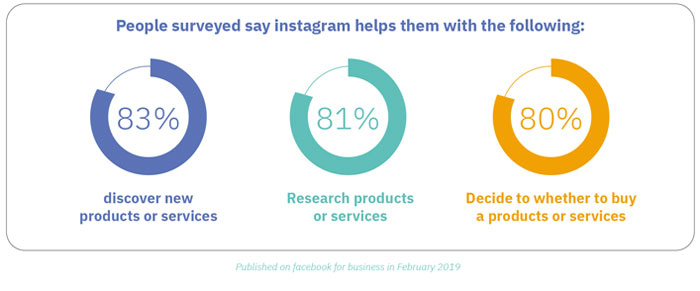

Instagram is a huge leader in this social commerce space. Data shows 81% of consumers search for products on Instagram, largely because users are walking billboards for their clothing.

It’s a high value social channel for many retailers because it’s 25% more likely that Instagram users are in the top income quartile than average Internet users.

Similarly, Facebook Shops helps retailers capitalize on the fact consumers are always ready to purchase.

Promising to deliver customers a new “mobile-first shopping experience,” Shops give brands a Facebook-hosted shopfront to sell their products through.

Retailers can engage with shoppers through other Facebook-owned tools like Instagram, Messenger and WhatsApp. There’s no need for customers (or retailers) to use additional tools to sell through Facebook’s platform—highlighting the importance of ease and convenience by making the shopping experience a seamless part of someone’s digital platforms.

This type of shopping experience blends purchasing into people’s everyday consumption of digital media. Social channels have also provided another emerging shopping trend – livestream retail. The launch of platforms like Amazon Live, for example, invite beauty, food and fitness influencers to host live streams on their branded platform. It’s comparable to old-school shopping channels like QVC, only modernized and featuring “hosts” with an existing following elsewhere.

The growth of other tools with similar set-ups—like Google’s Shoploop, Talkshoplive and Brandlive—indicate that livestream retail isn’t slowing down anytime soon. It’s an alternative shopping avenue that offers the best of both worlds – using an influencer’s loyal and engaged audience on a platform you own and using their endorsements to sell your stock.

From a shopper’s side, the entire experience is simplified. Shoppers can be entertained and informed about a product, and buy that item without leaving the platform. It makes shopping an event by taking advantage of the new ways people are consuming content.

The appearance of voice assistants in people’s homes has presented yet another opportunity for people to shop with minimal effort. Think about the growth of Amazon Alexa – the smart speaker currently being used by one in every four American adults.

Alexa’s focal selling point is convenience. Users can buy anything they wish by simply saying “Alexa” in a room where the device is present. “Hey Alexa, order me a new pack of batteries” is a string of words that Amazon processes as a sale, taking money from their pre-registered card and having it shipped immediately.

This is a particularly effective way of selling for products that are repeat and regular purchases, like groceries, beauty and other household goods. Ordering products without search or comparison also locks the consumer into repeat purchases of the same brand, and without consideration for the price or any competitor products or promotions.

For a winning customer experience, convenience is key. Placing your product or brand as seamlessly as possible into people’s everyday lives, by taking advantage of the shopping tools and platforms now available, provides another significant opportunity to capture new customers and grow your market share.

Trend 6: Diversification of supply chains

Both Brexit and COVID-19 wreaked havoc on supply chains, and the ability of sellers to receive goods and fulfill orders.

Trade in and out of the country was uncertain and the supply of goods from other countries (and sometimes, other parts of the same country) was hit and miss. It wasn’t guaranteed to get the products you’d ordered because of limitations with global trading.

Retailers with suppliers in South-East Asia, India and China were especially impacted by COVID-19 restrictions. Some stockpiled goods that they couldn’t shift, others had to deal with long lead times on items they usually turned around within a few weeks.

So, what does this look like going into 2021? The long-lasting effects of both COVID-19 and Brexit still cause uncertainty.

Regulations for shipping goods between the European Union and the UK are changing. UK retailers have their access to the European Fulfilment Network revoked, forcing brands to create new supply chains and wrestle with VAT complications. If you’re one of the 66% of businesses using just Amazon fulfillment centers to ship products, you’ll feel Brexit’s knock-on effect of cross-border trade, too.

You’ll need to store all of your goods for UK customers inside one of Amazon’s UK fulfillment centers. Yet the Pan-EU Programme, which offers EU retailers faster shipping and easier cross-border retail, won’t be available to UK retailers after Brexit is finalized. British retailers will need to split goods for European customers in two different warehouses – one for UK customers, and another for EU customers, undoubtedly causing issues with supply chains.

One thing is clear – retailers will need to adapt their selling, pricing and logistics strategies to accommodate these changes. Companies need business and supply chain continuity to maintain delivery times with their customers. And if not, mitigation strategies to overcome them are crucial.

One strategy is dual sourcing – receiving identical products from two suppliers. This means you still get supply of that product from one if the other has issues. It significantly reduces the risk of having zero supply of goods, especially if both suppliers are in different countries.

All of this boils down to diversifying the supply chain. A combination of local and international suppliers that you can source products from as and when they’re needed reduces risk, even if travel restrictions continue, a warehouse is closed due to an outbreak, and international trade deals are limited due to government restrictions.

This diversification tactic follows through to your fulfillment and shipping teams, too. For example, you could use UPS for half of your domestic orders, Amazon’s European HQ for a quarter, and your own in-house distribution team for the rest. That way, slow shipping times from one supplier doesn’t need to have a devastating impact on store-wide customer service.

When shoppers looked for out of stock products during COVID, just 13% returned to the retailer’s website to buy the item, while 37% went to a different store to complete their purchase. As a result of inconsistencies with stock availability, three-quarters of consumers have tried new brands or places to shop throughout the pandemic.

If you can’t fulfill an order, there will be retailers on the same platform or one google search away who will be able to take your customer’s order. A constant, reliable supply chain will maintain your inventory, and therefore maintain your customer’s loyalty and your market share.