A list of payment gateway providers

Launching a successful ecommerce site is no easy feat.

In fact, it requires making decisions on everything from website hosting and ecommerce platforms, right through to branding and marketing strategies.

But another area that’s just as important is ecommerce payments.

After all, being able to process online transactions is arguably the most crucial part of running an online store.

Now while you’re probably familiar with the various payment methods – debit and credit card payments, PayPal and even digital wallets such as Apple Pay – what you may not be familiar with is how exactly they work on a website.

Well, the short answer is through the use of a payment gateway.

Payment gateways specifically enable your customers to enter their information in a secure way, while also communicating with your bank to ensure the payment is legit.

But, what are the leading payment gateway providers?

Throughout this article, we have listed nine of the most popular services worldwide, detailing key information and covering everything from benefits to payment gateway fees.

We’ve also included information on the payment gateways supported by each of the leading ecommerce platforms, including Shopify, Magento, BigCommerce, and WooCommerce.

List of payment gateway providers

Adyen

Built using a modern infrastructure that connects to more than 200 payment methods and card networks worldwide, Adyen has fast become a leading payment gateway service across the globe and is even trusted by brands such as Microsoft, Uber and Tory Burch.

In fact, the payment service has made headlines in recent years due to its exponential growth rate and the fact that it is replacing PayPal as eBay’s new payment processor.

So, what else is there to know about using Adyen?

Well aside from the fact that it is available in countries across Europe, North America, LATAM, APAC and Africa, which is certainly a benefit if you’re looking to expand internationally, it also offers a number of additional features including risk management, revenue optimization and detailed customer insights.

When it comes to costs, Adyen’s fees differ depending on the market itself and the payment method the customer opts for. You can view Adyen’s full price list here.

It is worth noting, however, that there are no monthly fees or integration fees, but they do have a minimum invoice of $120 per month. For merchants in Asia Pacific, this is $1,000.

Stripe

Another payment gateway provider of choice, Stripe supports transactions within 34 different countries, making it a service worth considering for your payment processing needs.

In fact, with developer-centricity at its core, Stripe is a highly adaptable platform that gives you as the merchant the opportunity to fully customize your payment forms.

That’s not the only benefit though.Through its revenue optimization feature, you can access financial reports and draw insights that will help you make better business decisions and improve efficiency.

When it comes to payment options, Stripe supports all major credit and debit cards worldwide, along with digital wallets such as Alipay, Amex Express Checkout, Apple Pay, Microsoft Pay, Visa Checkout and WeChat.

As with most providers, it is also an incredibly safe and secure system that complies with Strong Customer Authentication (SCA), a new European regulation introduced to reduce fraud and enable secure payments.

But what about costs?

While there are various prices depending on location and payment methods, for European debit or credit cards you can expect a 1.4% fee and an additional £0.20 charge per transaction. Businesses accepting more than £50,000 per month can benefit from customized pricing.

Braintree

Trusted by brands such as airbnb and Skyscanner, PayPal-owned Braintree is another payment gateway service to consider.

In fact, not only is Braintree renowned for their seamless checkout process, which has been proven to boost conversions, they also offer global reach, covering more than 40 countries and 130 currencies, while charging no additional foreign exchange or cross-border fees.

With regards to the payment methods they enable, these include all leading debit cards, credit cards and digital wallets, as well as both PayPal and US mobile wallet app, Venmo.

But what do they charge?

While Braintree offer a transparent pricing model of 1.9% plus £0.20 per transaction, they do also offer tailored pricing for businesses with higher transaction volumes.

It’s also worth noting that while basic fraud protection tools are included with their standard option, they do also offer more advanced protection for an additional fee, partnering with Kount to reduce fraudulent transaction attempts.

Worldpay

WorldPay is perhaps one of the most popular payment gateway services out there, processing around 42% of transactions in the UK alone.

The company’s reach does extend beyond the UK though, providing access to over 300 payment methods and card networks in more than 140 countries. In fact, with their network of banks worldwide, you will be able to accept international payments without incurring unnecessary fees.

That’s not all though.

WorldPay even have experts dotted around the globe to provide advice on global payment options.

Given the sheer size of the company (they process billions of transactions every year), the system is also incredibly scalable and flexible, making it suitable for businesses of all sizes.

Now when it comes to WorldPay’s fees, it’s worth noting that they offer two pricing plans.

More specifically, merchants can benefit from a pay-as-you-go pricing structure which incurs a 2.75% rate on both credit and debit card payments, along with a 20p transaction fee, or alternatively pay a fixed £19.95 monthly payment which eliminates the 20p fee and lowers the debit card transaction charge to 0.75%. With the monthly payment option, credit card transactions will still incur the 2.75% rate.

Further reading: How to optimize your ecommerce customer experience to deliver sales growth and customer loyalty.

Website Payments Pro

Website Payments Pro, also known as PayPal Payments Pro, is the organisation’s own payment gateway service.

Now aside from the recognizable brand powering this payment service, it does offer several other benefits.

To start with, it enables payment to your PayPal account within minutes, even for card payments.

In addition to this, it offers advanced fraud management filters and address verification checks, provides a fully customizable checkout which can help with conversion rate optimization, and is already integrated with many of the leading ecommerce solutions, making getting started simple.

It can’t, however, be ignored that this service does only offer two payment options – PayPal or Debit or Credit Card – and you won’t be able to offer digital wallets as a payment method if you opt to use Web Payments Pro.

But what does it cost?

To make use of this service, you’re looking at £20 monthly fee, plus a 3.40% and £0.20 transaction fee.

Authorize.net

Handling more than 1 billion transactions every year, Visa-owned Authorize.net is another leading payment gateway provider worth mentioning.

If you’re based in the US, UK, Canada, Europe or Australia, one of the biggest advantages of using this solution is that they accept international transactions.

In fact, in addition to accepting payment in GBP, Euros and US Dollars, thanks to their partnership with Evo Snap they also accept Swiss Franc (CHF), Danish Krone (DKK), Norwegian Krone (NKK), Poland zloty (PLN) and Swedish Krona (SEK), which can be an advantage if you’re looking to reach these markets.

Payment gateway isn’t their only offering though and they do also offer a merchant account, that being a type of bank account that enables retailers to accept and process card payments.

With this in mind, Authorize.net has two pricing plans; Gateway only and Merchant Account and Payment Gateway.

If you’re only considering their payment gateway service then you’re looking at £19 per month (excluding VAT), £0.10 per transaction (excluding VAT) and a set-up fee of £35.

For the alternative option, you will also incur a £19 monthly fee and £35 set-up cost, however you will be charged 2.49% and £0.15 per transaction. That said, with this option, you will also be able to take advantage of their additional services at no extra cost. This includes access to their fraud prevention suite, automated recurring billing and digital invoicing.

SagePay

Given that SagePay is one of the highest rated payment platforms on the market, it’s certainly one that should be explored.

As with many alternative solutions, payment security and fraud reduction are at the core of all their plans and you can take advantage of their tools at no extra cost. In fact, when opting for any of their plans, you will benefit from 24/7 support, phone payments and eInvoice payments.

Now while we’re on the topic of SagePay’s plans, what’s perhaps most interesting about their offering is that they charge a flat monthly fee, as opposed to the percentage or fee per transaction incurred by many of the other leading payment gateway providers.

But what exactly are these flat monthly costs?

Well to start with, the SagePay Flex plan will set you back £27 per month and is suitable for merchants processing up to 350 monthly transactions. They also offer a £45 per month Plus plan for retailers processing up to 3,000 transactions and for anything higher, they offer a Corporate package with bespoke pricing.

Now in addition to accepting PayPal payments and all major card types, they do also support various local European payment methods, including giropay, SOFORT, eps and iDEAL.

Amazon Pay

With lack of trust often cited as a top reason for shopping cart abandonment, inclusion of the recognizable Amazon Payments option on your checkout can certainly help in boosting conversions.

In fact, not only is this something that can easily be enabled by using Amazon Pay as a payment gateway on your site, it is also trusted by brands such as Paul Smith, Oasis Fashion, Dyson and even National Express.

So, how does it work?

With Amazon Pay enabled, customers can complete their purchase using their existing Amazon credentials. In addition to this helping speed up the entire checkout process by pre-populating fields, the familiar checkout experience further instills trust in your brand and ultimately reduces cart abandonment.

Now despite as many as 310 million users across the globe being Amazon customers, as this payment option requires shoppers to have an Amazon account to proceed, it can’t be ignored that you could be losing sales by not providing alternative payment options.

And, to offer more payment options, you will need to make use of an additional payment gateway provider in addition to Amazon Payments, which does of course come at an extra cost.

Speaking of costs, it’s worth noting that Amazon Pay operate a transaction-based pricing model. Depending on what your monthly payment volume is, you will incur a processing fee of between 1.4% and 3.4%, as well as a £0.20 authorization fee per transaction.

There are, however, other charges to be aware of, including a cross border fee of between 0.4% and 1.5% for international transactions, as well as a currency conversion fee of 2.5%.

Klarna

While Klarna works in a slightly different way to the other payment gateway providers listed in this article, it’s one worth detailing, nonetheless.

Why?

Simply because Klarna is becoming a payment method of choice amongst as many as 60 million consumers worldwide, thanks to its option to slice payments into three installments, or pay later, the latter of which is unique to the UK market.

Perhaps the best part, however, is that as the merchant you still get paid immediately, while further benefiting from an increased average order value and improved checkout rates.

So, what does it cost to use Klarna?

While you can see the full pricing list here, Klarna’s pricing is split into two fees – a transaction fee and a variable fee – and differs based on location and whether the payment is pay later, sliced or pay now.

As an example though, UK merchants can expect to be charged a £0.20 transaction fee, as well as a variable fee of between 1.90% and 2.90%.

Payment gateway integrations

The geographic location of your customers isn’t the only factor to consider when choosing your payment gateway service.

In fact, you will need to consider which solutions your chosen ecommerce platform supports.

To help with this, we have provided some information for Shopify, Magento, BigCommerce and WooCommerce below, as well as the appropriate links for each.

Shopify payment gateways

Shopify partners with more than 100 leading payment gateway providers across the globe, which means that it shouldn’t be a barrier to choosing your payment service of choice.

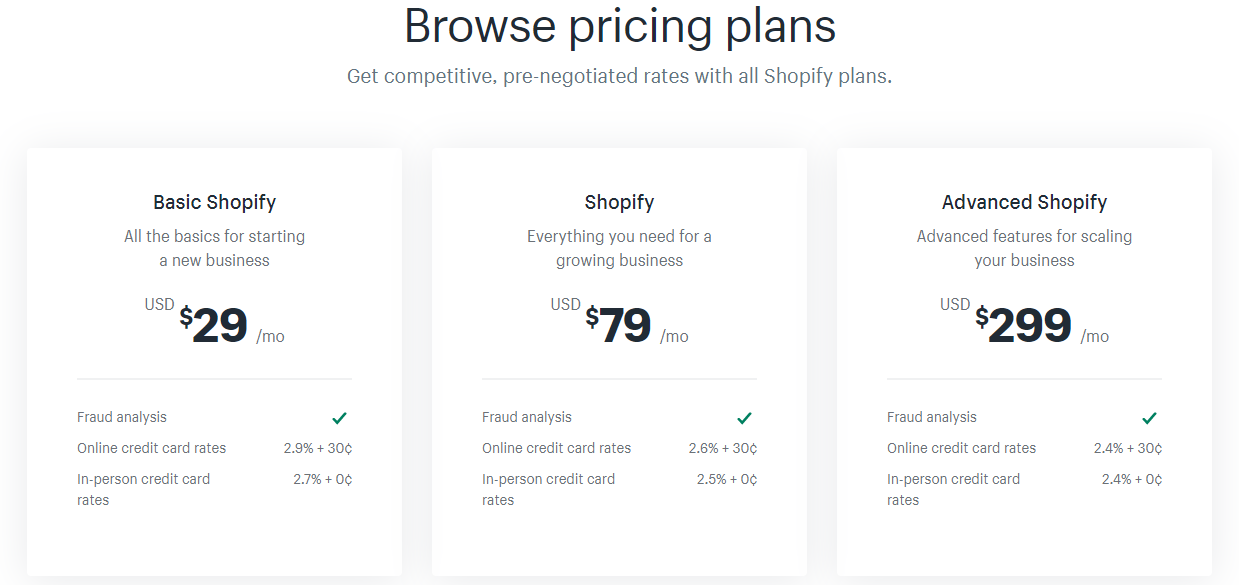

While you can see the full list of supported Shopify payment gateways here, it’s also worth noting that they do in fact operate their own payment gateway – Shopify Payments.

Shopify Payments not only accepts all major payment methods – Visa, Mastercard, American Express, Apple Pay and Google Pay – it also really easy to set up, you just need to switch it on.

As with anything, it does come with a price tag, which we’ve listed below.

Magento payment gateways

Despite only providing out-of-the-box integrations for 13 payment gateways, it should be noted that Magento is an open-source ecommerce platform, and as such any additional payment gateway services can still be integrated.

Take a look at the list of enabled Magento payment gateways here.

BigCommerce payment gateways

BigCommerce integrates with more than 65 payment gateways, covering over 100 countries and supporting 250+ payment methods.

You can view the full list of BigCommerce supported payment gateways here.

WooCommerce payment gateways

Another ecommerce platform with a wide selection of payment gateway integrations is WooCommerce.

Here’s the thing though.

While many can be integrated with your WooCommerce store free of charge, several (including some of those listed on this page) do incur a fee. These fees do, however, entitle you to one year of updates and support.

View the full list of WooCommece payment gateways here.

Multiple payment gateways

If businesses have one thing in common, it’s their ambition to grow.

For many, this will mean into new territories.

The problem is, the ability to scale is often constrained by the limitations of your chosen suppliers, in this case your payment gateway provider.

Now while many of the providers listed above offer a variety of payment methods and support multiple currencies, it’s unlikely you’ll find one that meets the needs of customers in every corner of the globe.

And, that’s before you consider payment preferences that aren’t a standard option, for example Amazon Pay.

Which is why more and more retailers are opting to use more than one payment gateway service.

The challenge, however, is that this can become increasingly complex – not to mention increase your costs if you are choosing providers that charge a monthly fee as opposed to fee per transaction – and that not all ecommerce platforms will allow you to integrate multiple payment gateways.

With this in mind, if this is something you need then it is recommended that you include it as a requirement when researching website platforms.

So, there you have it. A list of some of the best payment gateway providers available to you.