How to overcome your toughest ecommerce cash flow challenges

The importance of having enough funds on hand is well known to all entrepreneurs, and when it comes to selling online things are no different. Even the best online sellers experience drops in sales and supply-chain complications which can impact cash flow. But sometimes it’s opportunities that drive the need for more funds.

In Quickbooks’ 2019 The State of Small Business Cash Flow report, 61% of businesses from around the world revealed that they have struggled with cash flow, with 42% experiencing challenges in the 12 months prior to the report. However, despite these hardships, Amazon’s 2020 SMB Impact Report shows how eCommerce continues to thrive.

So, as an online seller, what are some of the financial challenges you might face and how can you overcome them to increase your chances of success? Let’s get started and dive straight in.

Challenge #1: Delays in Marketplace Payouts

Whether you’re selling on Amazon or one of the many other marketplaces out there, most cash flow problems result from delays between the point of sale and the marketplace payout of your earnings.

Even though the sale itself happens quickly, with some orders being purchased, shipped, and delivered in the span of only a day or two, it can take much longer to see the funds hit your bank account. Meanwhile, as you wait for your profits, you still must cover your inventory, marketing, fees, and logistics costs.

Challenge #2: Inventory Demands to Expand Your Business

Another common reason for cash flow issues is the inventory struggle. Unless you’re drop-shipping, you need to buy your inventory in order to have products to sell. If you can get that inventory at a discounted bulk price, you’ll want to do that, and a steady and reliable cash flow is crucial for taking advantage of those opportunities.

This sounds easy enough in theory, but when you take into account the delays between the sale and the payout from the marketplace, this challenge can be a difficult one, especially for new sellers. Even after all the profits land in your account, there’s a limit to how much growth you can achieve.

Let’s use Luke as an example:

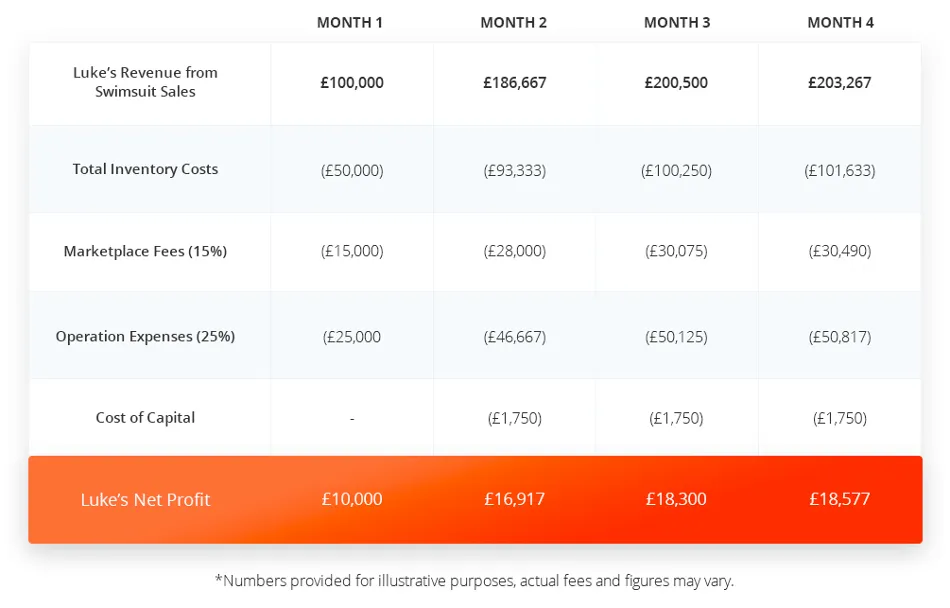

Luke has been selling swimsuits for years, and his swimsuits cost him £10 per unit to stock. Luke has £50,000 to start the quarter, so he buys 5,000 units which he will sell for £20 each. His gross earnings are £100,000 but when you subtract the cost of goods (£50,000), the ~15% marketplace fee (£15,000), and the ~25% operational expenses (£25,000), Luke is left with £10,000 profit.

If he continues to invest the profits back into his business as the quarter proceeds, he’ll start to see growth, as seen in the table below:

As you can see, between months 1 and 4, Luke has only been able to grow his business by just under 25%. This is primarily due to Luke’s profits being tied up in additional inventory.

Likewise, the constant demand for more inventory to expand your business means your funds are often tied up. So, how can you grab the opportunity of an upcoming peak consumer spending season and cash in on potential sales? Everything is delayed, including your earnings, and now you need cash to get more of the right inventory – that’s the cash flow problem.

Solving the Cash Flow Problem.

To solve the cash flow challenge and take advantage of potential growth opportunities, there are many kinds of funding solutions, each with pros and cons. Here are some of the popular options:

Loans – Business Term and Personal.

A business term loan is a lump sum of capital that is repaid with regular payments at a fixed interest rate. This traditional financing option can be found at banks and credit unions, and more recently is offered by online direct lenders. Loan amounts vary widely depending on your Amazon business’s revenue and your credit history and qualifying for them can be challenging.

Like business term loans, personal loans also require you to qualify. However instead of using your business to determine your eligibility, you’ll need to rely on your credit score.

Most lenders will need the same basic information in order to consider you for a business loan or other similar funding options for your online store. These are some of the documents you may need to present in order to secure working capital as an Amazon merchant:

- Business and personal tax returns

- Business and personal bank statements

- Profit and loss statements

- Business plan

- Financial records

- Credit history

Once you’re prepared, you can determine what seller funding options works best for your store and your needs, goals, and potential.

Credit Card Financing and Business Lines of Credit.

With often sky-high interest rates, using your business credit card as a financing solution may cost you big in the long run. While it may be tempting to cover some short-term expenses, make quick seasonal purchases and unforeseen product procurement or get your Amazon business stocked quickly. If you decide to finance with a credit card, be sure to repay the full amount as soon as possible or negotiate the lowest interest rates available.

Not unlike a credit card, a business line of credit gives you the ability to use money for purchases or cash withdrawals up to a set amount. Loan amounts from a line of credit vary widely, like business term loans, and will largely depend on the eligibility of your Amazon business.

Loans and credit cards, of course, are viable ways to grow your business. But Payoneer is offering the Linnworks community a new approach to easing their cash flow – the Capital Advance program.

Capital Advance from Payoneer.

Payoneer’s Capital Advance can help you grow your business by offering short-term cash boosts that can help with day-to-day needs and inventory costs. As you accept and successfully settle your Capital Advance offers, you can become eligible to receive larger cash injections to really kick business growth into gear.

Although the size of the offers you receive will depend on your online store’s sales performance, all working capital offers include three great features that make Capital Advance the ideal cash flow management solution:

- Instant funds with no credit checks or collateral

Payoneer extends working capital offers based on your marketplace sales history and you can get the funds in your Payoneer account with just a few clicks.

- Gradual settlement from marketplace sales

Once you accept the offer, Payoneer will collect a portion of your future marketplace sales. That means they only get paid when you do, while leaving you with cash to maintain your business between payout dates. After an offer is completely settled, a new offer will follow it, subject to eligibility requirements.

- One low, fixed fee

There’s nothing worse than the surprise fees and hidden costs that can really impact your bottom line. With Payoneer, you’ll only be charged one fee after you finish settling your advance and you’ll see the fee amount before you accept the offer.

Capital Advance in Action.

To see how this works in practice, let’s revisit Luke’s swimsuit business. This time however, Luke has accepted a £100,000 Capital Advance after his first month of sales. If Luke uses a third of his advance (£33,333) each month to increase his inventory without going over his forecasted sales expectancy, his store earnings and profits would look very different. By the end of month 4, he would have grown his monthly profits from £10,000 to £18,577.

As you can see, the growth potential is much greater with the extra boost of a Capital Advance and leads to a profit gain of an impressive 86% between months 1 and 4, compared to 25% growth from the same store without the advance.

So if you are looking to grow your eCommerce business so you can be like Luke, click here to learn more about working capital, or contact Scott Thomson at Payoneer (scottth@payoneer.com) today.

About the author.

This post was written by Peretz Eisenberg, lead writer for Capital Advance at Payoneer